Video Sources 32 Views Report Error

Synopsis

Infamous outlaw Harland Rust breaks his estranged grandson Lucas out of prison, after Lucas is convicted to hang for an accidental murder. The two must outrun legendary U.S Marshal Wood Helm and bounty hunter Fenton “Preacher” Lang who are hot on their tails. Deeply buried secrets rise from the ashes and an unexpected familial bond begins to form as the mismatched duo tries to survive the merciless American Frontier.

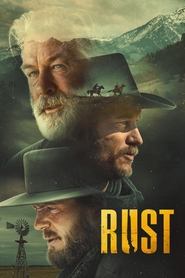

Original title Rust

IMDb Rating 5.3 2,194 votes

TMDb Rating 6.345 55 votes

Director

Director

Cast

Harland Rust

Wood Helm

Lucas Hollister

Fenton 'Preacher' Lang

Evelyn Basset

Clete LaFontaine

Boone LaFontaine

Blackburn

Drum Parker

Big Bill Cochrane